Operations / Compliance

|

Asset Controls O&M Services Import/Export Risk Mitigation Compliance CEO Consulting Commissioning Public Relations Sales Solutions Sustainability |

|

Next Generation Solutions

Socioeconomic Development

Business Lines

|

DIONISIO GROUP

|

DIONISIO CAPITAL

|

INFRASTRUCTURE

|

|

REAL ESTATE

|

TECHNOLOGY

|

COMMERCE

|

Legacy of Success

40 (+) Years Experience

Operations Summary

Dionisio Operations embodies (2) principle entities: 1.) Dionisio Group - Global Asset Development (GAD), total project delivery solutions and asset control systems 2,) Dionisio Capital - consisting of the acclaimed Dionisio Capital Club, the executive level private membership organization of international business owners, Fortune 1,000 Board of Directors, corporate CEOs, sole proprietors, A-List celebrities and the world's leading philanthropists. Dionisio Capital operations focus on executive relationship management, socioeconomic education, macroeconomic strategies and entertainment. Dionisio is the innovator of comprehensive, broad spectrum prosperity generating solutions, business / government coalitions and community development. A seamless, unified team environment with a network of resources in 100 countries. World-class services to empower business and improve financial success with talented, qualified professionals with real-time practical experience from the largest and most influential companies to small, nimble and more aggressive firms. This enables clients to implement aggressive, income generating solutions, yield substantial cost savings and reach the highest platitudes of performance. To witness client team members succeed within their own company and life is one key measure of exceeding expectations in combination with the desired results of the scope of services provided. Dionisio provides solutions within business development, project management and operations management with a client base ranging from international investors, property owners, entrepreneurs to Fortune 500 companies, Government institutions and non-profits. We complement and enhance your in-house capabilities (or) performs total projects and services enabling you to realize our legacy of comparative advantages. Simply stated, The Dionisio Group of Companies, preeminent development covers all aspects of product and project development. Dionisio Capital focuses on relationship management of top leaders to improve and celebrate multicultural prosperity, leadership mentoring, global structures, education systems, business intelligence and hallmark socioeconomic development. Dionisio forms world class winning teams for corporate operations, business / Government coalitions, facilities management, and multi-asset development solutions second to none. Extensive industry knowledge, executive prowess and unique risk mitigation techniques combine with strategic global team alliances to maximize prosperity for all. CEO, Robert Dionisio actively participates in Governance, relationship building, education, mentoring and public key-note speaking engagements.

Regions / Sectors

Socioeconomic Ecosystems (SE) include but are not limited to the following: 1A.) Dionisio lead omnipresent Global Asset Development (GAD) - the unified maximum growth, risk mitigation, global umbrella development vehicle covers all our multi-asset development zones and business sectors; which also allows focused investment concentrations by region(s), cultural heritage and experience level. GAD is continuously, deep in the trenches, scouring, analyzing and evaluating extraordinary opportunities in 100 countries: 1B.) Made In America (within the United States only) 2.) Italian American / Italian (Global) and/or Made In Italy 3.) Irish American / Irish (Global) and/or Made In Ireland 4.) United Kingdom (Global) and/or any preferred UK country 5.) Latin American / LatinX (Global) any Latin country including: Mexico, Colombia, Brazil and more 6.) Spanish (Global) 7.) European Union (Global) and/or any of 28 EU countries 8.) Canadian American / Canadian (Global) and/or Made In Canada 9.) Asian American and/or any country in Asia (except North Korea) 10.) Chinese American / Chinese (Global) / Hong Kong (Global) and/or Made In China / Made In Hong Kong 11.) Indian American / Indian (Global) and/or Made In India 12.) Native American (Indigenous Tribes) and/or Made In U.S. Tribal Nations) 13.) Australian (Global) and/or Made In Australia 14.) Russian American / Russian (Global) and/or Made In Russia 15.) Eastern European (Global) and/or any EE country 16.) Middle Eastern (Global) 17.) UAE 18.) Saudi Arabia 19.) Kuwait 20.) Qatar 21.) Israel 22.) Bangladesh 23.) U.S. Virgin Islands 24.) Caribbean Islands and 25.) African American (Global) / African and/or Made In Africa | #GADSE

Dionisio Capital Coalition / Partner Regional Business Centers / Territories: New York, Miami, San Francisco, Seattle, Atlanta, Rome, Florence, Venice, Zurich, Geneva, Berlin, Frankfurt, London, Dublin, Paris, Monaco, Barcelona, Madrid, Amsterdam, Stockholm, Oslo, Vienna, Prague, Shanghai, Hong Kong, Shenzhen, Singapore, Tokyo, Seoul, Melbourne, Dubai, Doha Qatar, Kuwait, Riyadh, Jerusalem, Istanbul, Delhi, Toronto, Vancouver, Mexico City, Bogota, Rio de Janeiro, Nassau, US Virgin Islands, Moscow, Marrakesh, Cape Town SA

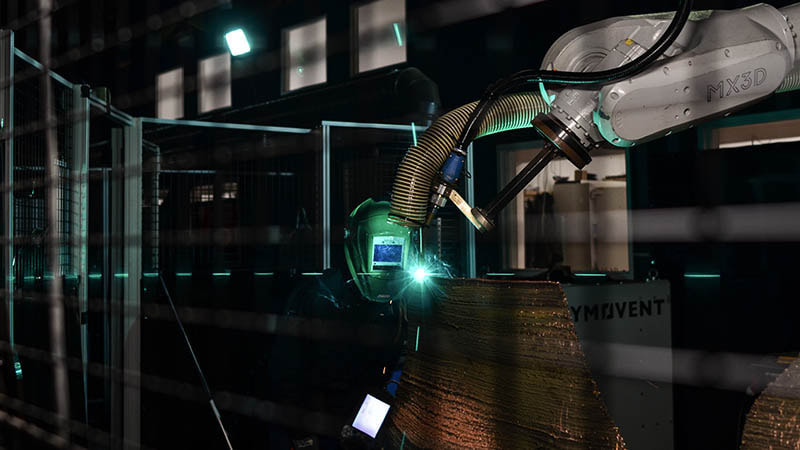

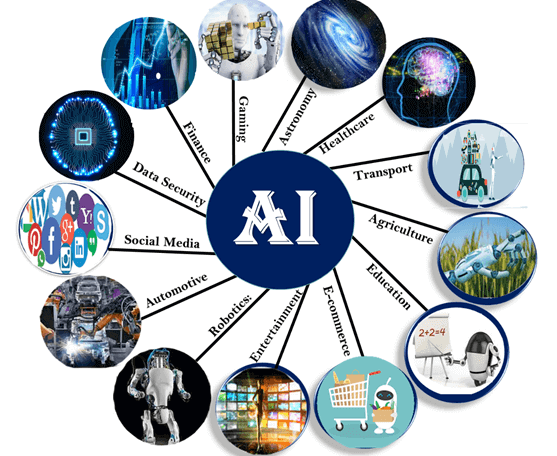

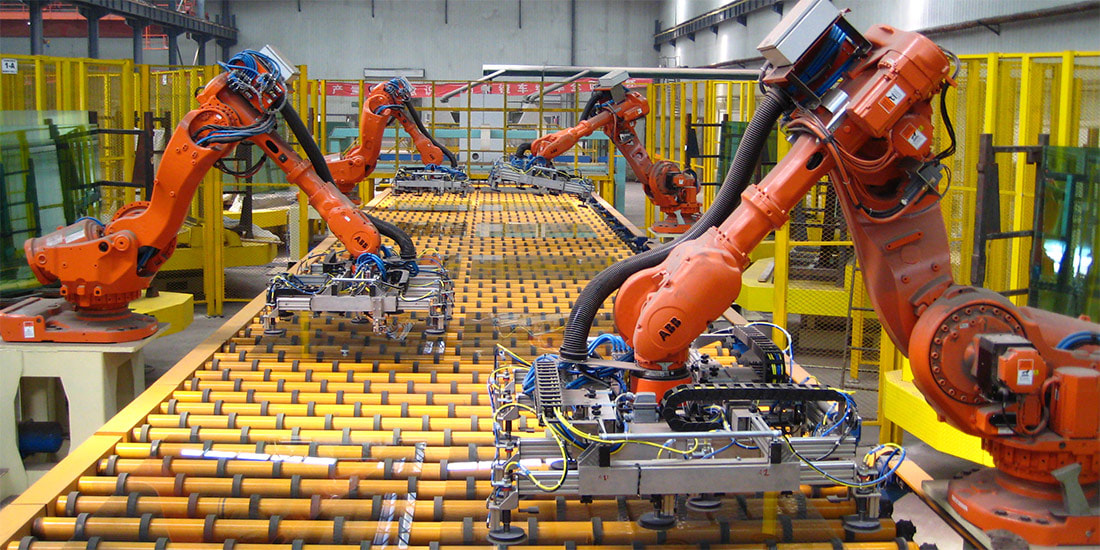

Few Select Development Business Sectors: Advanced Technology, Financial Institutions, Real Estate - Luxury, Commercial, Industrial, Infrastructure. Dionisio's Top (20) Manufactured Products List, Energy & Power Systems, Next Generation Energy Solutions, Renewable Energy, Oil & Gas, Chemical, Ecosystem Reconstruction, Negative Emissions, Circular Sustainability, Next Generation Transportation, Ports and Infrastructure, Next Generation: Security and Communications, Medical Centers / Equipment, Nanotechnologies, Robotics, Artificial Intelligence Integration (AII), Advanced Quantum Computing (AQC), High-Tech Start-Up, IPOs, Space Based Technologies / Facilities, Lean Operations, DevSecOps, Blockchain, NTF (Several), Bitcoin, Ethereum (ETH), Digital Currencies, Entertainment, Commerce: Import-Export, Commodities, Mining, F&B, Fine Art, Fashion, Healthcare, anti-Aging / Beauty.

Socioeconomic Ecosystems

Dionisio U.S. Laws, Rules and Regulations Compliance Policies

NOTICE: Dionisio's approved lists of outside investment bankers, project financiers and crowdsource fundraising entities must abide by all U.S. Laws, SEC Rules & Regulations, Foreign Trade Agreements and Government imposed embargoes and/or sanctions, (and) Dionisio reserves the right to deny or reject any investment or project in any geographic location due to unsafe or forecast, volatile political affairs that cause physical security concerns or other unsatisfactory risk to stakeholders. Be certain to check the current status for temporary or long term exclusions. Circumstances in the global economy are fluid, managing disruption is one of Dionisio's key, core strengths but we provide helpful industry information only. Nothing on our websites, in social media or any communications made by Dionisio, its officers or representatives should be misconstrued as financial advice or a securities offer. It is your responsibility to seek financial advice, legal counsel and conduct risk assessments for any regulated securities investments or transactions. Dionisio does not provide financial advisory, real estate brokerage, securities brokerage, insurance brokerage (or) public accounting.

Dionisio Group charter(s) are: executive management, product/project development, product/project design build, program management, project controls, management consulting and any lawful business activity. Dionisio Capital is a private operating company involved in executive level relationship management, socioeconomic development, P2P/B2B/P3 coalitions, global development, entertainment and any lawful activities. Dionisio Capital is not an SEC regulated investment company and does not offer financial advisory or securities to the public. Dionisio Group, Dionisio Capital and/or any of its officers (herein known as "Dionisio" are not investment advisors, securities traders or brokerage-dealers. Dionisio does not trade in equity, debt or hybrid securities. Any stocks, bonds, credit, equity transfers, investment funds or other financial instruments (and) transactions, are made through Dionisio's approved Top 20 Financial Institutions List - updated each year to maximize dynamic industry trends, satisfaction levels and financial vehicle preferences. They include the world leaders of finance, with long standing track records of SEC Rules & Regulations compliance, accreditation and the highest levels of safeguards and legal compliance including Red Flags Rule and Know Your Customer / Client (KYC). Dionisio's legacy of executive experience, global affairs, internal Asset Control / Compliance Monitoring System (DACCM), risk management, due diligence, capital management knowledge ad discernment capabilities combined with the sophisticated financial protections provided by these select institutions - exposure to fraud, unethical predators and criminality are substantially mitigated. Dionisio performs its due diligence responsibly, abides by industry Best Practices and adheres to all U.S. and EU Laws, Rules, Regulations, Foreign Trade Agreements, Embargoes and Sanctions. Dionisio, its officers and Governance policies require the reporting of any known criminal activities, cyber security interference, ethical misconduct, civil rights violations and/or suspicious behavior to the appropriate Governing authorities and law enforcement agencies within applicable national and local jurisdictions. Dionisio maintains a (40) year Zero Tolerance Policy related to unethical misconduct and/or criminal business activities.

Dionisio U.S. Embargoes / Sanctions Compliance

Dionisio Asset Control / Compliance Monitoring System closely tracks U.S. OFAC, EAR, TAR, European Union, United Nations and Dionisio Global National Partners (DGNP) electronically in real time (daily). We publish the current U.S. list of associated sanctions by nations - SPCI (on a quarterly basis strictly for general, helpful information purposes only. US, EU, UN and other Dionisio Transnational government sanctions range from broad geographic locations, others are Targeted (TAR), down to specific categories, enterprises and individuals. U.S restrictions are covered in Sanctions Programs and Country Information, OFAC’s Specially Designated Nationals and Blocked Persons List (SDN List) and Other Sanctions Lists (OSL) U.S. persons are prohibited from dealing with SDNs regardless of location and all SDN assets are blocked along with entities owned, consisting of 50% interest or more are also blocked | #DACCMS

Balkans Sanctions 02/03/2017, Belarus Sanctions 04/19/2021, Burma-Related Sanctions 04/21/2021, Burundi Sanctions 06/02/2016, Central African Republic Sanctions 08/07/2020, Chinese Military Companies Sanctions 03/14/2021,Countering America's Adversaries Through Sanctions Act of 2017 (CAATSA) 03/02/2021, Counter Narcotics Trafficking Sanctions 04/23/2021, Counter Terrorism Sanctions 03/25/2021 Cuba Sanctions 04/13/2021 Cyber-Related Sanctions 04/15/2021,Democratic Republic of the Congo-Related Sanctions 03/10/2021, Foreign Interference in a United States Election Sanctions 04/15/2021, Global Magnitsky Sanctions 04/26/2021, Hong Kong-Related Sanctions 03/17/2021, Iran Sanctions 03/05/2021, Iraq-Related Sanctions 12/23/2020, Lebanon-Related Sanctions 07/30/2010, Libya Sanctions08/06/2020, Magnitsky Sanctions 12/10/2020, Mali-Related Sanctions 02/06/2020, Nicaragua-Related Sanctions 12/21/2020, Non-Proliferation Sanctions 03/02/2021, North Korea Sanctions 12/08/2020, Rough Diamond Trade Controls 06/18/2018, Russian Harmful Foreign Activities Sanctions 04/15/2021, Somalia Sanctions 04/27/2021, Sudan and Darfur Sanctions 04/12/2021, South Sudan-Related Sanctions 02/26/2020, Syria Sanctions 04/05/2021, Syria-Related Sanctions 12/22/2020, Transnational Criminal Organizations 04/07/2021, Ukraine-/Russia-Related Sanctions 03/02/2021, Venezuela-Related Sanctions 03/31/2021, Yemen-Related Sanctions 03/02/2021, Zimbabwe Sanctions 08/05/2020. | Office of Asset Control Embargoes/Sanctions List Update. OFAC

Dionisio U.S. Partnerships / Outside Agencies - Financial Compliance Policy

Dionisio’s Governance policies, risk management and global development procures; requires all financial partners and contracted financial service providers comply with the following: Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA) and all State authority rules and regulations within their jurisdictions. SEC regulates investment advisors over $110MM million in assets under management (AUM). However, investment advisors and their representatives with (AUM) less than $110MM are required to register with their states. FINRA enforces SEC rules, regulations and oversees public brokerage firms, broker-dealers and individual brokers. Asset managers providing: advisory, financial planning, investment strategies, mutual funds, equities, fixed income, private investment funds, and exchange-traded funds (ETFs) are also regulated by the Federal Reserve, U.S. Treasury, and FDIC. Registration does not signify or imply that any advisor is endorsed by Dionisio, its officers, the SEC or any regulatory agency. The financial firms have only made disclosures and agree to abide by Dionisio operating policies, strictly adhere to all SEC rules and are subject to unscheduled audits by Dionisio, the SEC and/or FINRA. A summary matrix / overview is as follows:

Dionisio U.S. Partnerships / Outside Agencies - Financial Compliance Matrix

Securities and Exchange Commission (SEC) for AUM exceeding $110MM | Financial Industry Regulatory Authority (FINRA) All investment advisors | The Federal Reserve (Fed) Central Bank of the United States government | U.S. Treasury Department: Taxes, Government finance, bonds, banknotes, coins. | Federal Deposit Insurance Corporation (FDIC) Insures deposits up to $250,000 per insured bank. | Office of the Comptroller of the Currency (OCC) National banking regulations | Financial Stability Oversight Council (FSOC) Coordinating bank regulation and monitoring systemic risks within financial industry. | The Securities Act of 1933. Primary market (IPOs) to ensure transparency and informed decisions. | The Securities Exchange Act of 1934. Secondary market to prevent fraud in the trading of existing securities between investors. Also created the Securities and Exchange Commission (SEC) | Trust Indenture Act of 1939. For debt securities like bonds, debentures, and notes. | Investment Company Act of 1940. Companies investing, reinvesting, and trading in securities, and offering own securities. | Investment Advisors Act of 1940. For the registration of money managers and mutual fund managers. | Securities Investor Protection Act of 1970 (SIPA). Created the Securities Investors Protection Corporation (SIPC). | Sarbanes-Oxley Act of 2002. Enhanced responsibility and financial disclosures, combats corporate and accounting fraud. | Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. For consumer protection, trading and financial product regulation, credit ratings, corporate governance and disclosure, and transparency. | Other Self-Regulatory Organizations (SRO): New York Stock Exchange (NYSE) / National Association of Securities Dealers (NASD) / MSRB (Municipal Securities Rulemaking Board) makes broker-dealer and other trading municipal securities. CBOE (Chicago Board Options Exchange) which regulates options trading. NFA (National Futures Association) self-regulatory organization for U.S. derivatives industry, on-exchange traded futures, retail off-exchange foreign currency and OTC derivatives. | DACC Compliance Matrix Summary

NOTE: All U.S. investment firms contracted or utilized by Dionisio that sell investment products are required to hold the following FIRA licences: Series 6 License - to sell packaged securities, mutual funds and variable annuities. (Not individual stocks or bonds) Series 7 License – to sell stocks, bonds, options, and futures and packaged securities (except commodities) Series 3 License – for those who sell commodities. Series 63 License - required by every state for financial advisors to conduct business. Series 65 License - for financial advisors compensated with fees not commission. Financial advisors who hold a professional CFA or CFP may be eligible to have their Series 65 requirement waived by FINRA but Dionisio requires this for its Governance policies and due diligence.

Dionisio U.S. Partnership / Outside Agencies - License Requirements

Real Estate Broker’s License – issued by Real Estate Commission within state jurisdiction; and REALTOR® association membership; agreeing to abide by a strict Code of Ethics | Insurance Brokers License – issued by Insurance Commission within state jurisdiction w/ Insurance Brokers Bond - surety agreement between 3 parties: broker, the surety agency and the state; and National Insurance Producer Registry (NIPR) | General Contractor’s (GC) License – issued by state of jurisdiction as required for construction companies. | Architects - issued by state of jurisdiction as required for architecture companies. | Professional Engineering (PE) License – issued by state of jurisdiction as required for engineering companies. | Attorney / Lawyers - Licensed by State Bar of Jurisdiction - Minimum 10 years experience in the area of expertise needed with demonstrated, successful track record of industry knowledge, mediation skills and often complex international legal matters. | Certified Financial Advisor (CFA) Institute – charter holders for all certified financial individuals / advisory firms. | Certified Public Accountant (CPA) for all certified accounting individuals / firms; States' DOR / the American Institute of Certified Public Accountants (AICPA) and administered by the National Association of State Boards of Accountancy (NASBA) | All Other State, County, City, Local Licenses/Rules and Regulations. | DionisioLicenses/ComplianceMatrixFile

Dionisio International Commerce Exchange (DICOMX) Compliance Summary

All U.S. Partnerships, Contractors and other Outside Agencies must comply with Dionisio Operating Policies and all U.S. Laws, Rules and Regulations including but not limited to the following: The Export Administration Regulations (EAR) Bureau of Industry and Security (BIS) - Department of Commerce for EAR regulated “dual use” goods and services (having both military and civilian uses) identified in Commerce Control List (CCL) | The International Traffic in Arms Regulations (ITAR) - State Department’s Directorate of Defense Trade Controls (DDTC) determined by the State Department as listed on the U.S. Munitions List (USML) - items are not readily identifiable as inherently military in nature such as research satellites, small research submersibles are included. The Treasury Department’s Office of Foreign Assets Control (OFAC) economic and trade sanctions | Custom Requirements and Documentation | All Product Standards – including but not limited to: US, EU, CE mark and China CCC mark. | Tariffs and Free Trade Agreements | Discriminatory Barriers | U.S. and European Union Privacy / Data laws: EU General Data Protection Regulation (GDPR) - rules for the protection of personal data and for the movement of data in the EU. | U.S. Export Control Laws & Regulations for: 1.) transfers of controlled information; including technical data, to persons and entities outside the U.S 2.) Shipment of controlled physical items, such as scientific equipment, that require export licenses from the U.S. to a foreign country 3.) verbal, written, electronic, or visual disclosures of controlled scientific and technical information related to export controlled items to foreign nationals (“deemed exports”), even within the U.S. 4.) transactions with sanctioned, embargoed countries or restricted or debarred individuals or entities.

Federal Regulations on Export Control Summary

Department of State Directorate of Defense Trade Controls - International Traffic in Arms Regulations (ITAR) | Department of Commerce - Bureau of Industry and Security / Export Administration Regulations (EAR) | Census Bureau - Foreign Trade Regulations (FTR) | Department of Treasury Office of Foreign Asset Controls - Sanctions Regulations | Department of Energy - Assistance to Foreign Atomic Energy Activities / Nuclear Regulatory Commission / Export and Import of Nuclear Equipment and Material | U.S. Export Control Licensing: Projects / technologies that are export controlled need an export license unless an exception or exclusion applies or a license is not required. Note that "deemed exports" may also require a license. Export licenses initiated and coordinated through your location Export Control Officer. ITAR licenses coordinated with Export Control Officer and submitted by the UC Office of the President through Ethics, Compliance and Audit Services. Due diligence is required by all before any exporting activities ensue.